Navigating the Shifting Sands of Medicare Part D: Why Formulary Insights Are Critical for 2026 Planning

The Medicare Part D landscape is undergoing seismic changes, driven by the Inflation Reduction Act (IRA) and new legislative shifts like H.R.1. For pharma leaders, market access teams, and healthcare executives, staying ahead of these trends is no longer optional, it’s essential. Here’s why Magnolia’s Part D Formulary Databook is your key to unlocking actionable insights.

Medicare Part D Trends Are Reshaping Patient Access

2025 open enrollment revealed how Medicare Part D plan sponsors limited MA-PD and standalone Part D offerings — critical context for 2026 planning. These shifts provide essential context for 2026 planning. This was due to various market, healthcare utilization, and policy trends, including the IRA.

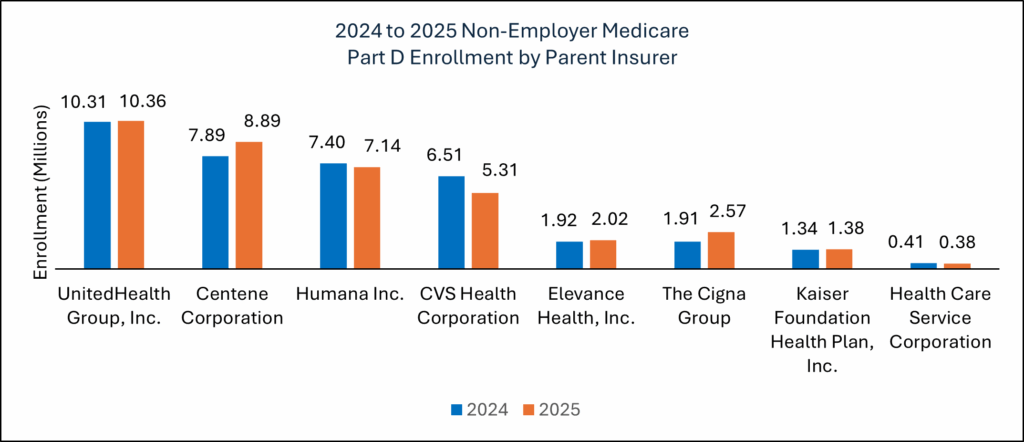

2025 enrollment data revealed significant shifts between large standalone Part D plans. Manufacturers should factor these trends into their 2026 strategies. Patients moved their enrollment away from plan sponsors like CVS/Aetna and UnitedHealth Care and moved to plan sponsors like Centene/WellCare, Humana, and Cigna.

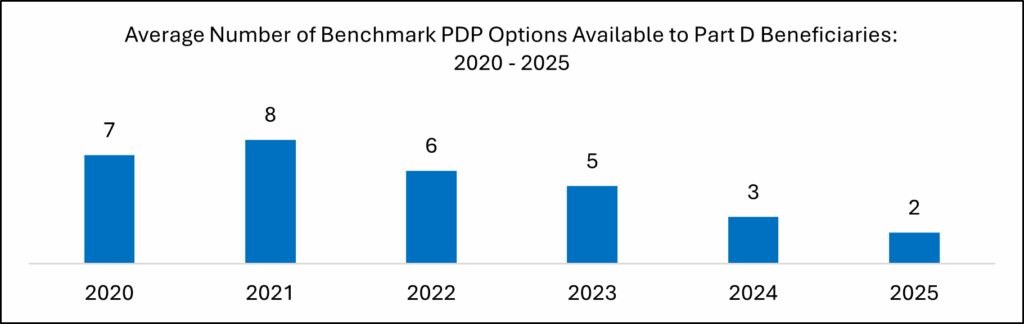

- Additionally, Part D plan sponsors limited their plan options that qualify for 100% premium coverage for Medicare’s ‘Extra Help’ program during the 2025 open enrollment period.

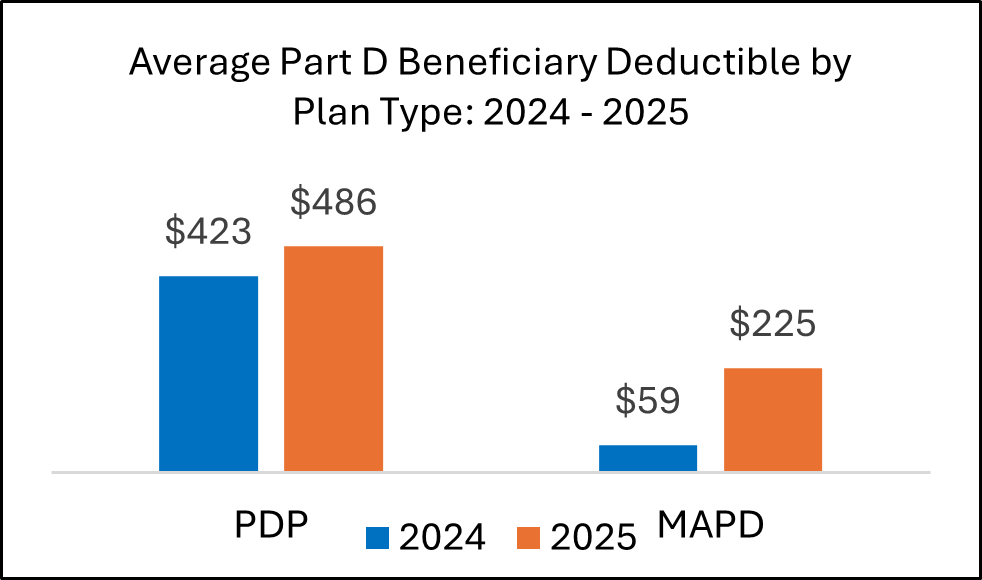

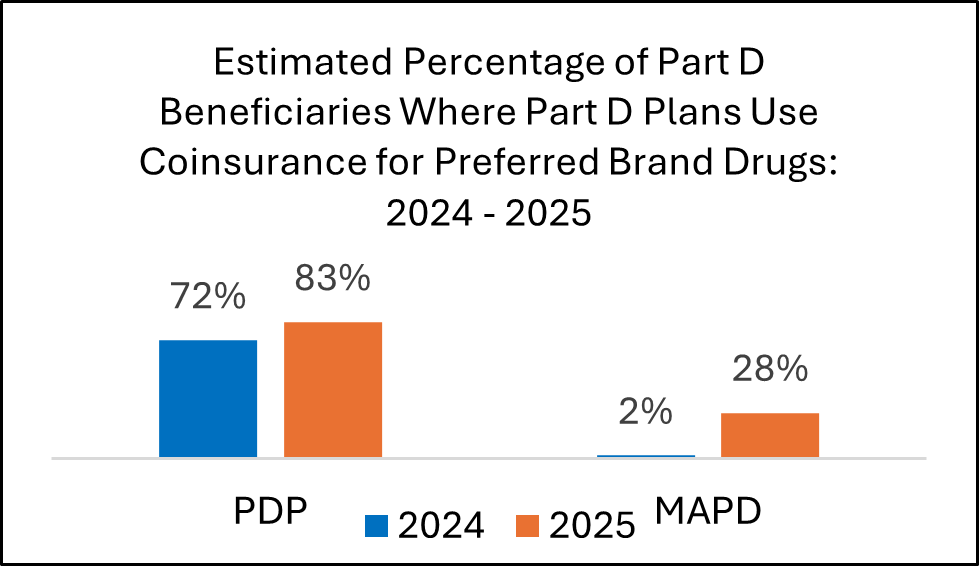

In 2025, many plans raised patient deductibles and placed more brand drugs into coinsurance tiers. These changes will shape contracting and access approaches for 2026.

H.R.1 and IRA Updates Add Complexity

The recent H.R.1 legislation, also known as the “One Big Beautiful Bill Act”, and Trump administration policies are reshaping the IRA’s impact and will continue the Part D market instability that started in 2025:

- Medicare Drug Price Negotiation Program (DPNP): Expanded exemptions for orphan-designated drugs with multiple indications and a revised negotiation timeline offer pharma brands extended pricing power, though only for those who strategically align their pipelines.

- Low-Income Subsidy (LIS) Challenges: H.R.1’s rollback of streamlined LIS enrollment and Medicaid cuts could reduce access for low-income patients, increasing OOP costs.

- Part D Premium Stabilization Demo (PDP Demo): Changes for 2026, including a reduced premium subsidy ($15 to $10) and a higher premium cap ($35 to $50), signal rising premiums and potential shifts from standalone Part D plans to Medicare Advantage Part D plans (MA-PDs). This could reshape formularies and patient access.

Add to this the looming impact of tariffs raising manufacturing costs and Most Favored Nation (MFN) pricing models raising drug costs for Part D plans, and it’s clear: pharma brands must be able to anticipate and adapt for another year of Part D market instability.

Positioning Your Brand for Success

Magnolia’s Part D Formulary Databook empowers you to navigate these changes with precision. Our data-driven insights help you:

- Track Formulary Shifts: Understand how utilization management (UM) tools like prior authorization and step therapy, along with tier changes, impact your brand’s access.

- Monitor Financial Dynamics: Stay ahead of rising deductibles, premiums, and cost-sharing trends to anticipate patient affordability challenges.

- Inform Strategic Decisions: From pipeline planning to payer negotiations, our Databook provides actionable intelligence to optimize market access and maintain competitive positioning.

- Anticipate Policy Impacts: Assess how IRA provisions, H.R.1 changes, and emerging policies like tariffs affect your brand’s coverage and patient outcomes.

Don’t let policy shifts catch you off guard. Contact us today to learn how Magnolia’s Part D Formulary Databook can equip your team with the insights needed to thrive in 2026 and beyond.