How The 340B Program Impacts Federal & State Tax Liability

Data Analysis:

How Forgone Rebates Due to 340B Correspond to Lost Tax Revenue at Federal and State Levels

Designed to support eligible providers furnishing services to a high volume of uninsured or low-income patients, the 340B drug pricing program is often touted as cost-free to taxpayers. However, a recent study found that the program displaces manufacturer rebates to commercial health insurance plans. Our analysis expands on these findings and details tax impact for both self- and fully insured employees and workers across the US.

What you’ll learn in this summary data analysis:

- Understanding the purpose of the 340B program

- Review one way that the 340B program drives up costs for employers, the government, and taxpayers

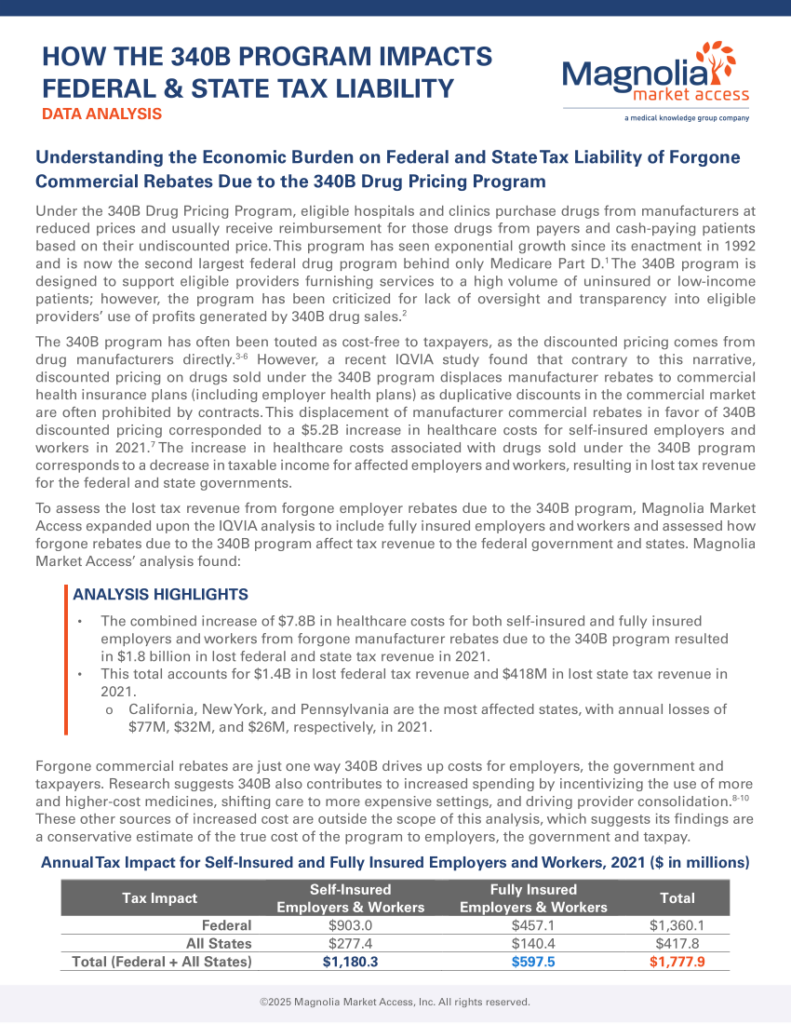

- Quantify increases in healthcare costs associated with utilization of the 340B program

- Assess lost tax revenue at federal and state levels from forgone rebates due to the 340B program

Download the analysis summary to understand how displacement of commercial rebates due to 340B program corresponds to lost tax revenue for federal and state governments.